Courtney Schmidt, Sector Manager, Wells Fargo Agri-Food Institute with contributions from Tim DiGiulio, Head of Sustainable Finance & Advisory, Wells Fargo Commercial Banking

Sustainable aviation fuel has been an industry discussion topic for several years, but widespread commercial production appears ready to expand and take flight. One might ask what this has to do with the food and agribusiness industry, so let’s put that in context starting with an understanding of the fuel.

What is sustainable aviation fuel (SAF)?

Made from a variety of different feedstocks, SAF is a replacement for conventional, fossil-based jet fuel with highly reduced carbon emissions. Current permitting allows a blend of 10-50% of SAF with traditional fossil-based fuel, however the airline transportation sector is conducting tests with 100% sustainable aviation fuel.

In a former article entitled “How renewable diesel is a game changer in the U.S. soybean market,” the Wells Fargo Agri-Food Institute discussed renewable diesel fuel made from soybean oil. And, in this article, we’ll take a look at SAF and creation from feedstocks, though it involves more rigorous refining to become a replacement for jet fuel. Also, SAF still requires a blend with traditional fossil-based fuel, while you can run 100% renewable diesel in engines.

Both renewable diesel fuel and SAF use similar feedstocks in processing, so this ultimately has them competing for feedstocks and refining capacity. A big focus within the aviation sector is to use feedstocks that can be repeatedly resourced without depletion of a natural resource, avoiding competition with traditional food and fiber resources.

Why is sustainable aviation fuel important?

Aviation accounts for 2% of all carbon dioxide (CO2) emissions worldwide and 12% of total transportation CO2 emissions. SAF is seen as a critical component in helping the commercial aviation industry achieve its long-term climate pledge of net-zero carbon for air transport by 2050.1 Further, the White House set an ambitious goal of reducing U.S. aviation emissions by 20% by 2030, a step toward the net-zero emission goal in 2050. It’s reported that SAF could contribute approximately 65% of the emission reduction needed to reach these goals.

Sustainable aviation fuel credits

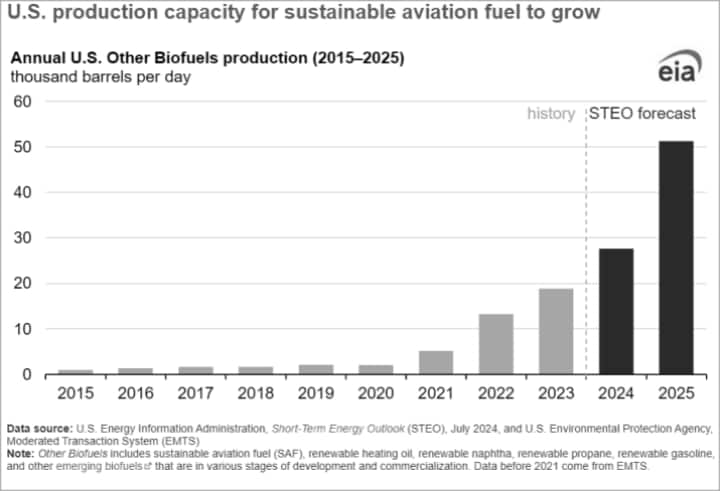

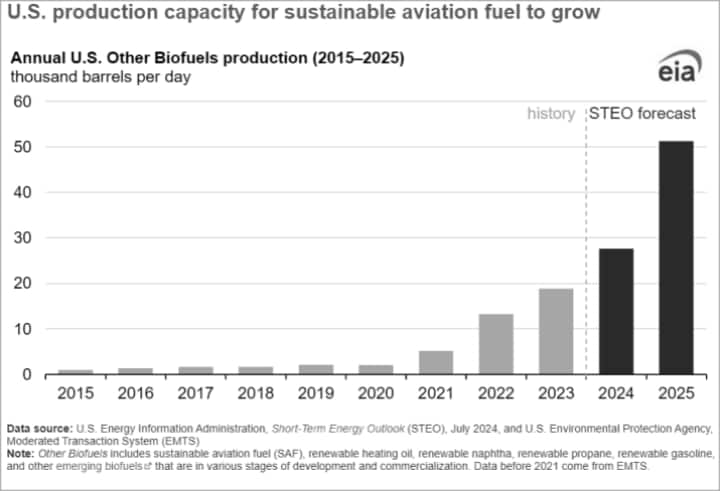

Production of sustainable aviation fuel is rapidly increasing, with forecasted production in 2024 expected to jump to nearly 30,000 barrels per day. However, this is still well below the 1.6 million barrels of jet fuel consumed per day in the U.S,4 leaving plenty of runway for rapid expansion. For perspective, the Administration’s goal of production of 3 billion gallons of sustainable aviation fuel annually by year 2030 only equates to approximately 196,000 barrels per day.

It’s important to realize that sustainable aviation fuel is more expensive to produce than traditional fossil fuels, or even other renewable fuels. In April 2024, the White House released its guidance on a subsidy program to support SAF production, and Congress approved a Producer’s Tax Credit of $1.25 per gallon. To qualify, the sustainable aviation fuel must be produced in the U.S. and cut greenhouse-gas emissions by at least half compared to conventional jet fuel, although the feedstock used in the production process does not have to be U.S.-grown. Greenhouse gas reductions beyond 50% include an additional subsidy up to $0.50 per gallon.

The new subsidy program also includes a USDA pilot program to encourage farmers to “bundle” climate smart agriculture practices for SAF feedstock. Starting in 2025, corn-based ethanol producers can earn a Clean Fuel Production Credit, known as 45Z, if they incorporate multiple practices like no-till farming, cover crops and enhanced efficiency fertilizer. Soybean SAF producers can earn the tax break if they practice no-till farming and cover cropping.

Battle of the feedstocks

As mentioned, sustainable aviation fuel can be made from a variety of feedstocks including oilseed crops, sugar crops, waste oils/fats, municipal waste, and cellulosic waste. There are currently seven SAF production pathways that utilize different feedstocks and involve different production methods as illustrated by the chart below.

SAF Production Pathways

| Pathway | Feedstock | Certification Name and Blend Limit |

| Fishcher-Tropsch | Energy crops, lingocellulosic biomass, solid waste | FT-SPK (up to 50%) |

| Hydroprocessed Esters and Fatty Acids (HEFA) | Waste fats, oils, greases (FOGs) from vegetable and animal sources | HEFA-SPK (up to 50%) |

| Direct Sugars to hydrocarbons (DSHC) | Conventional sugars, lingocellulosic sugars | HFS-SIP (up to 10%) |

| Fischer-Tropsch with Aromatics | Energy crops, lingocellulosic biomass, solid waste | FT-SPK+A (up to 50%) |

| Alcohol to Jet (AtJ) | Sugar, starch crops, lingocellulosic biomass | ATJ-SPK (up to 50%) |

| Catalytic Hydrothermolysis Jet (CHJ) | Waste fats, oils, greases (FOGs) from vegetable and animal sources | CHJ or CH-SK (up to 50%) |

| HEFA from Algae | Micro-algae oils | HC-HEFA-SPK (up to 10%) |

Source: Air Transport Action Group, Fly Net Zero; Beginner’s Guide to Sustainable Aviation Fuel, Edition

4

An important callout is that other biofuels such as renewable diesel and ethanol compete with SAF for the same feedstocks. The carbon intensity of each feedstock plays an important role as a lower carbon intensity score equals higher tax credits for processors. Let’s review some of the top U.S. feedstocks and discuss the pros and cons of each related to sustainable aviation fuel production.

- Corn / Ethanol – Used in the Alcohol to Jet (AtJ) pathway

- Pros: Ample supplies of corn exist in the U.S., and there is a mature U.S. ethanol industry. As the U.S. moves towards more electric vehicles, excess ethanol production could shift towards sustainable aviation fuel production. A new AtJ production plant, LanzaJet, is set to open in mid-2024 in Soperton, GA with 10 million gallons/year production. Both SAF and renewable diesel fuel will be produced.

- Cons: Most AtJ sustainable feedstock is currently being imported into the U.S. The LanzaJet plant is expected to begin production using imported sugar cane from Brazil since many of the large sugar mills in Brazil have already been certified to meet the international SAF feedstock standards. It may take time for U.S. corn to find its way into sustainable aviation fuel production.

- Soybean Oil

- Pros: Plentiful supplies in the U.S. and well-established supply and infrastructure chain.

- Cons: Virgin vegetable oils such as soybean oil and canola have a higher carbon intensity score than other feedstocks. Soybean meal is a by-product produced during the crushing process. While a valuable feedstock to animal production, ability for the global livestock industry to absorb excess soybean meal is a concern.

- Camelina / Carinata – Two promising, new U.S. commercial oilseed crops that are in the same family as Canola.

- Pros: These crops are being tested in Minnesota and Kansas for use as a harvestable cover crop for farmers and are considered more resilient oilseed crops with higher cold or drought tolerance than canola. A central idea is that farmers could generate a new revenue stream during the winter when their ground is laying fallow, and it wouldn’t take away from conventional crop production. New, but limited crop insurance programs have recently been approved for these crops.

- Cons: Crop production is in early-stage development and will require infrastructure. Uncertainty exists regarding the potential volume of crop that can be grown across the U.S.

- Used Cooking Oil or Tallow (animal fat) – Used in the HEFA production process, the leading pathway for sustainable aviation fuel production.

- Pros: Currently one of the most popular feedstocks due to price, availability, and a lower carbon intensity score than other feedstocks and domestic and import supply is available.

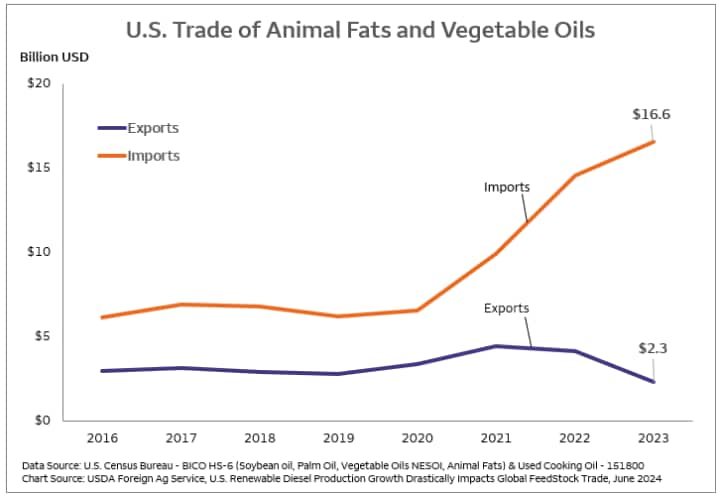

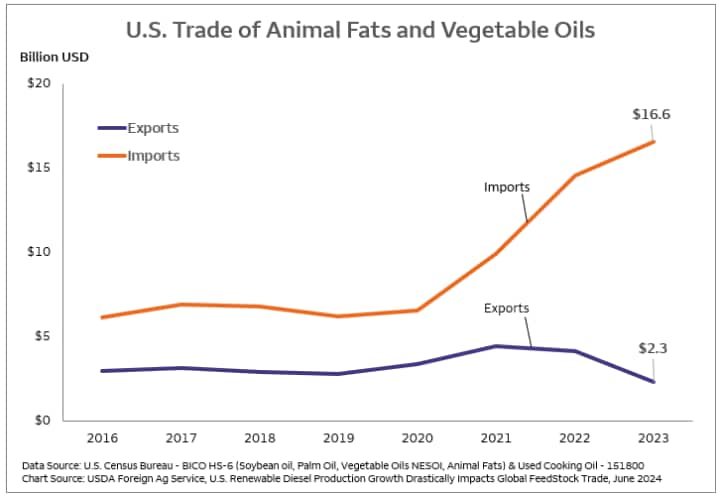

- Cons: Supply constraints around the expansion of livestock production and availability of used cooking oil from restaurants. High volumes of imported used cooking oil from China and tallow from Brazil, have received negative publicity in the U.S. Risks include the possibility of higher tariffs on imports and concern over lower quality and fraudulent used cooking oil from China.

- Biowaste - Generated from waste products such as municipal solid waste, agriculture waste, wood, and energy crops and examples include product packaging, grass clippings, food scraps, clothing, corn stalks, forestry residues.

- Pros: Could potentially tap into a large pool of underutilized and low-cost waste products.

- Cons: Difficulty in building out facilities to capture waste gases. Fulcrum Bioenergy’s flagship facility in Nevada was one of the first commercial operations for converting landfill waste to renewable fuels, but the announced financial collapse and shuttering of Fulcum’s facility in June 2024 highlights the challenge of developing a commercially viable production facility using municipal waste.

At the end of the day, price, availability, and carbon intensity scoring will determine the winners of the feedstock battle. These factors are likely to ebb and flow as the sustainable aviation fuel sector grows and matures.

Partnerships taking flight

To hit the ambitious goals for reduced carbon emissions through sustainable aviation fuel, partnerships are developing across the industry – a prime example being the Montana Renewables multi-year collaboration with Shell Trading Company. In addition, traditional energy producers, such as Valero Energy and Phillips 66, are also working to convert parts of their existing production facilities over to sustainable aviation fuel production. Others partnerships involve sustainable aviation fuel production companies and airlines or airports. Farmers will also be an important part of the conversation because in order for farmers to increase the sustainability practices to facilitate the goals, they must be rewarded financially.

Large challenges remain as the industry works to scale up SAF production, including securing project financing for new processing plants. “Wells Fargo can play a unique and supportive role in the development of SAF since we bank stakeholders across the ecosystem," says Tim DiGiulio, Head of Sustainable Finance & Advisory, Wells Fargo Commercial Banking. “Although neutral regarding technology pathways, Wells Fargo’s Sustainable Finance teams can help to bring together finance partners, airlines, energy companies, government agencies, and universities to discuss the future of sustainable aviation fuel. We also recognize that the pathways, challenges, and opportunities of our clients vary across industries and regions,” stated DiGiulio.

Courtney Buerger Schmidt is a Sector Manager within Wells Fargo’s Agri-Food Institute focused on the protein, cotton, and hay sectors. Courtney originally joined Wells Fargo in 2014 as a relationship manager within The Private Bank Wealth Management group where she spent two years prior to assuming her current role. Before Wells Fargo, Courtney spent six years as a commodity broker and research analyst with Frontier Risk Management developing hedge and risk management strategies for Agribusiness clients, and also served as assistant director of the research division that focused on livestock, grain, and oilseed.

Courtney Buerger Schmidt is a Sector Manager within Wells Fargo’s Agri-Food Institute focused on the protein, cotton, and hay sectors. Courtney originally joined Wells Fargo in 2014 as a relationship manager within The Private Bank Wealth Management group where she spent two years prior to assuming her current role. Before Wells Fargo, Courtney spent six years as a commodity broker and research analyst with Frontier Risk Management developing hedge and risk management strategies for Agribusiness clients, and also served as assistant director of the research division that focused on livestock, grain, and oilseed.

Courtney holds a Bachelor of Science degree in Agricultural Economics with an emphasis in finance and real estate from Texas A&M University. Courtney was recently selected for Texas Agriculture Lifetime Leadership (TALL) Cohort XVIII 2022-2024. She is also a member of the Texas A&M College of Agriculture Development Council .

Sign On

Sign On

Courtney Buerger Schmidt is a Sector Manager within Wells Fargo’s Agri-Food Institute focused on the protein, cotton, and hay sectors. Courtney originally joined Wells Fargo in 2014 as a relationship manager within The Private Bank Wealth Management group where she spent two years prior to assuming her current role. Before Wells Fargo, Courtney spent six years as a commodity broker and research analyst with Frontier Risk Management developing hedge and risk management strategies for Agribusiness clients, and also served as assistant director of the research division that focused on livestock, grain, and oilseed.

Courtney Buerger Schmidt is a Sector Manager within Wells Fargo’s Agri-Food Institute focused on the protein, cotton, and hay sectors. Courtney originally joined Wells Fargo in 2014 as a relationship manager within The Private Bank Wealth Management group where she spent two years prior to assuming her current role. Before Wells Fargo, Courtney spent six years as a commodity broker and research analyst with Frontier Risk Management developing hedge and risk management strategies for Agribusiness clients, and also served as assistant director of the research division that focused on livestock, grain, and oilseed.