When it comes to saving for retirement, time is of the essence.

The power of time

Why is time of the essence? The sooner you begin saving – even small amounts – the better your chance of reaching your retirement goals. This is due to the power of compounding interest. And, this can be even more powerful if you invest in a tax-advantaged account like an IRA or qualified employer sponsored retirement plan (QRP) such as a 401(k), 403(b) or governmental 457(b). Consider the following hypothetical example that shows how much waiting to invest can cost.

Start early to save more with less

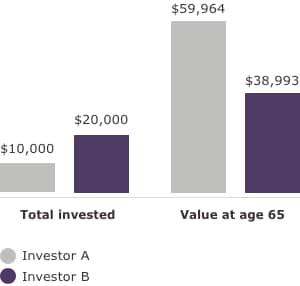

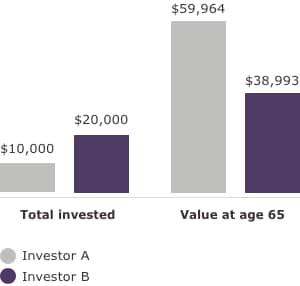

Investor A invested $1,000 per year for 10 years, beginning at age 30. Investor B also invests $1,000 per year, but began at age 45 and did so for 20 years. Even though Investor A saved half as much as investor B, Investor A had more money at the time of retirement, all because of starting earlier and the power of compounding interest. Investor B will have to save more to catch up. This is the cost of waiting, a cost that quickly adds up. It doesn’t matter what age you are – more time is on your side if you start saving for retirement today.

Putting time on your side

Investor A contributes $1,000 per year for 10 years ($10,000) to an IRA beginning at age 30. Investor B contributes $1,000 per year for 20 years ($20,000) to an IRA beginning at age 45. See what kind of impact time had on each investor's retirement savings.

Investor A contributes $1,000 per year for 10 years ($10,000) to an IRA beginning at age 30. Investor B contributes $1,000 per year for 20 years ($20,000) to an IRA beginning at age 45. See what kind of impact time had on each investor's retirement savings.

The example is hypothetical and assumes a 6% annual fixed rate of return and annual compounding. The growth of the assets is before tax and when distributions are taken from the account a portion will be taxed at an ordinary income rate. The chart does not represent the returns of any particular investment and should be not be used to predict or project performance. There is no guarantee you will earn 6% on investments and your account value may fluctuate over time. It assumes all earnings are reinvested and does not include transaction costs, fees, or expenses associated with the account or any individual investment made in the account.

This information is provided for educational and illustrative purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Investing involves risk, including the possible loss of principal. The accuracy and completeness of this information are not guaranteed and are subject to change. Since each investor's situation is unique, you should review your specific investment objectives, risk tolerance, and liquidity needs with your financial professional to help determine an appropriate investment strategy.

Wells Fargo and Company and its Affiliates do not provide tax or legal advice. This communication cannot be relied upon to avoid tax penalties. Please consult your tax and legal advisors to determine how this information may apply to your own situation. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your tax return is filed.

Investment and Insurance Products are: - Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC (WFCS) and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC (WFCS). Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

Sign On

Sign On

Investor A contributes $1,000 per year for 10 years ($10,000) to an IRA beginning at age 30. Investor B contributes $1,000 per year for 20 years ($20,000) to an IRA beginning at age 45. See what kind of impact time had on each investor's retirement savings.

Investor A contributes $1,000 per year for 10 years ($10,000) to an IRA beginning at age 30. Investor B contributes $1,000 per year for 20 years ($20,000) to an IRA beginning at age 45. See what kind of impact time had on each investor's retirement savings.