Improving your credit score takes perseverance, but it may pay off.

Trying to raise your credit score?

A higher score (especially above 760) may give you more options — and better rates — if you ever need a car loan, mortgage, or home equity line of credit. Even if you don’t have immediate plans to apply for financing, good credit may help you in other ways, like lower insurance premiums, renting an apartment and certain employers even run credit checks on job applicants prior to hiring them. Focusing on developing good long-term credit habits is an investment in yourself. Here are some specific actions you can take that may help to improve your score over time.

- Keep track of your progress. As you make changes, it will take time for your score to adjust. Scores update on a monthly basis, so be sure to track them regularly. You may be surprised to learn there are several different versions of credit scores available in the market. Be sure when you are comparing scores, you watch the score type and version (FICO® Score vs VantageScore®). Be sure you are tracking one score type consistently over time so that you are comparing apples to apples. As a Wells Fargo customer you may be eligible to access your credit score and credit report for free with Credit Close-Up®.

- Always pay bills on time. It may seem obvious, but a history of consistent on-time payments is one of the biggest factors in building a good score. Thirty-five percent of your FICO® Score is based on your payment history, so be sure to always make at least your minimum payment, and more if possible, on or before your due date every month.

- Keep credit balances low. How much credit you have available is another important scoring factor, making up 30% of your FICO® Score. To help maximize your score, you will want to keep balances as far below your credit limit as possible. While there is no set rule on credit utilization ratios, most experts recommend staying below 30% as a guideline (the lower the better) while still actively using your credit. This would mean you would want to keep your balance below $900 on a credit card with a $3,000 credit limit. Consider setting up balance alerts, so you are notified when your balance reaches a certain amount or percentage of your credit limit.

- Pay your credit cards more than once a month. Getting into the habit of making small payments throughout the month (often-called micropayments) instead of a payment once per month may help you keep your balance a little lower. This can help ensure you make your minimum payment each month and may result in a lower overall balance. A lower balance helps keep your utilization rate low, which positively impacts your score. Lower balances may also help reduce your interest expense if you carry a balance. Just be sure you have made at least a minimum payment by your due date to avoid any late fees.

- Consider requesting an increase to your credit limit. If you have had your credit card for a year or more, and made your payments on time, your card issuer may be willing to increase your credit limit. You will need to avoid the temptation of charging more on the card in order for this strategy to help you lower your utilization rate. Be aware that this request may result in a hard inquiry on your credit file, which may have a short term impact of lowering your score.

- Keep unused accounts open. The length of your credit history accounts for 15% of your score, so closing old accounts may negatively affect your score. Open accounts with no balances mean you have more available credit, so it may help your score by keeping them open and using them sparingly.

- Be careful about opening new accounts. Recent credit activity makes up 10% of your FICO® Score. Too many credit inquiries in a short period of time may hurt your credit score. If you need a new credit account and can comfortably manage the additional payments, great. But avoid anything that might strain your budget.

- Diversify your debt. Ten percent of your FICO® Score is determined by your “credit mix”. Creditors like to see a pattern of handling credit responsibly over time on a variety of account types, including installment loans and revolving credit (like credit cards and lines of credit).

Tip

Applying for credit may impact your score. If you’re a Wells Fargo Online® customer, checking your own score through your online banking account is complimentary and won’t hurt your credit.

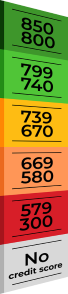

FICO® Score Rating

FICO® Score Rating

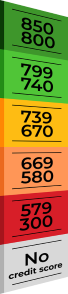

Exceptional (800 or better)

You may generally be able to qualify for the best rates, depending on your debt-to-income (DTI) ratio and the amount of equity you have in any collateral.

Very good (740 - 799)

You may generally be able to qualify for better rates, depending on your debt-to-income (DTI) ratio and the amount of equity you have in any collateral.

Good (670 - 739)

You may typically be able to qualify for credit, depending on your debt-to-income (DTI) ratio and the amount of equity you have in any collateral (but you may not get the best rates).

Fair (580 - 669)

You may have more difficulty obtaining credit and will likely pay higher rates for it.

Poor (300 - 579)

You may have difficulty obtaining unsecured credit.

No score -

You may not have built up enough credit to calculate a FICO score, or your credit has been inactive for some time.

Improve your credit opportunities

Explore strategies for managing your credit and debt.

You must be a Wells Fargo account holder of an eligible Wells Fargo consumer account with a FICO® Score available, and enrolled in Wells Fargo Online®. Eligible Wells Fargo consumer accounts include deposit, loan, and credit accounts, but other consumer accounts may also be eligible. Contact Wells Fargo for details. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

Please note that the score provided under this service is for educational purposes and may not be the score used by Wells Fargo to make credit decisions. Wells Fargo looks at many factors to determine your credit options; therefore, a specific FICO® Score or Wells Fargo credit rating does not guarantee a specific loan rate, approval of a loan, or an upgrade on a credit card.

Certain information provided by Fair Isaac Corporation, San Rafael, California.

Sign-up may be required. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

QSR-05272026-7171990.1.27

FICO® Score Rating

FICO® Score Rating