The most common way to purchase individual stocks is through a brokerage account. A Financial Advisor can help you select stocks. Explore these ways to invest with us:

- Previous

- Next

What they are

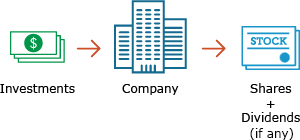

A stock is a type of security. It is a share of ownership in a company, which entitles the owner, also known as a shareholder, to own part of a company’s assets and a percentage of its profits if the stock pays a dividend. They can be considered a relatively risky investment, because they can potentially lose all of their value. However, they can also potentially increase in value over time.

How they work

When you buy a share of stock, you’re entitled to a small fraction of the assets of that company — even dividends, if the company’s management chooses to pay them. The value of the stock is set by many people trading it in a free, open market, most often a stock exchange. The price of a stock fluctuates according to supply and demand and many factors influence both.

Advantages and disadvantages

Stocks have their pros and cons depending on what you’re looking for.

Advantages

- Voting rights. There are various types of shareholders of which some can have voting rights. As company owners, common stock holders often can vote on matters like corporate policy, or who serves on its board of directors. In contrast, preferred shareholders generally are not allowed to participate in voting.

- Convenience. Stocks are often easy and inexpensive to trade.

- Higher potential return. If a company meets or beats profit expectations, its stock may increase in price over time. This is more true for common stock than preferred stock.

- Potential income. Some stocks, especially preferred stock, pay dividends which are subject to delay or elimination.

Disadvantages

- Price swings. Stock markets can be volatile and price swings can be frequent — which means your stocks could lose a substantial amount of value in a very short time.

- Not guaranteed. Stocks are not guaranteed to return anything to an investor. So, while the possibility for attractive returns is greater than with other investments, so is the possibility of losing money.

Types

Common stock and preferred stock

Common stock

Common stock, as you might guess, is the most common type of stock companies issue. It has the potential to increase in value through company growth and profits and may pay out dividends to shareholders. This type of stock also may allow shareholders to vote on things such as a company’s board of directors.

Investing involves risk including the possible loss of principal. Stocks offer long-term growth potential, but may fluctuate more and provide less current income than other investments. An investment in the stock market should be made with an understanding of the risks associated with common stocks, including market fluctuations. Dividends are not guaranteed and are subject to change or elimination.

Preferred stock

Preferred stock can be considered the most traditional type of preferred security. Preferred stocks offer investors other features that common stocks do not. For example, if a company goes bankrupt or is dissolved, a preferred stock shareholder will have dibs on assets before common stock shareholders. Preferred stocks typically pay out fixed, regular dividends, but they generally don't offer the growth potential of common stocks. They also generally don’t allow shareholders to participate in voting.

Terms can vary greatly among preferred stock, so it’s important to understand the features before you invest.

Preferred stock is a type of preferred security and there are special risks associated with investing in preferred securities. Preferred securities are generally subordinated to bonds or other debt instruments in an issuer’s capital structure, subjecting them to a greater risk of non-payment than more senior securities. In addition, the issue (or investment) may be callable, which may negatively impact the return of the security. Preferred dividends are not guaranteed and are subject to deferral or elimination.

Diversify to help manage risk

A typical investing mistake is to concentrate a large percentage of your money in one stock or one type of stock. To help manage risk, many investors diversify — which means they spread their investment dollars strategically among different assets and asset categories. Here are three ways to diversify.

Diversification does not guarantee profit or protect against loss in declining markets.

Sign On

Sign On