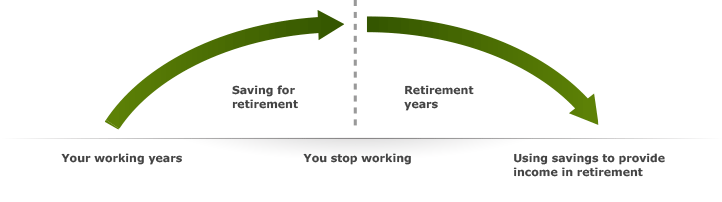

You’ve spent years saving money in anticipation of retirement, and while accumulating retirement savings is indeed important, it’s only half the story. What happens after you stop working? Your focus shifts away from saving money and toward using that money to live the retirement you want.

Generating your retirement income

Retirement is an exciting stage of life that many Americans eagerly anticipate, yet retirement as we’ve known it is changing. Different concepts of retirement are emerging — your personal vision of retirement likely differs from how your parents, neighbors, and friends expect to spend their retirement years. In addition, Americans today are living longer and are more responsible for funding their retirements than past generations.

As we navigate this continually evolving retirement landscape, it’s important that your retirement-planning process is unique to you and your situation. And remember that retirement income planning requires a different set of strategies, products, plans, and choices than saving for your retirement. Education and guidance can help you develop an income plan and a spending strategy that is right for you.

Understanding retirement income

While most people understand the importance of saving money for retirement, the concept of retirement income planning is less familiar. Let’s begin with some basic definitions.

- Retirement income is the money you use to cover your expenses when you stop working.

- Potential retirement income sources include Social Security, pensions, annuities, retirement savings from a qualified employer sponsored plan (QRP) like 401(k), 403(b) and governmental 457(b) as well as IRAs.

- Retirement income planning is the process of determining how much money you’ll need in retirement, and where your cash flow will come from each year. Retirement income planning involves four components:

- Planning: Write a plan that includes your expected retirement expenses to help provide a roadmap through retirement.

- Retirement investing strategies: Determine your various retirement income sources and consider the best way to invest your assets to help meet your retirement income goals.

- Managing your retirement money: Decide how to manage your money to help maintain a steady flow of income that will cover your expenses throughout your retirement years.

- Ongoing monitoring: Revisit and adjust your retirement income plan whenever your circumstances change, but at least once a year.

Benefits of planning your retirement income

What is your plan for using your hard-earned savings to produce a steady flow of income throughout your retirement years? Developing a written income plan can help you retire with confidence by considering questions such as: What do I want to do in retirement? Where do I want to live? Do I have enough to retire when I’d like? How do I create a steady income stream to take the place of my paycheck? How can I plan for the unexpected, such as extreme market fluctuations, health care needs, and other financial needs? And, will my money last throughout my retirement years?

Starting the retirement income planning process five to 10 years before you retire allows you time to develop a thoughtful, personalized plan that will help make the most of your hard-earned savings.

Tip

Maintaining several retirement accounts?

If you have multiple retirement accounts with various financial institutions or former employers, it’s important to know your options. We can help.

Sign On

Sign On