FDA approval is a foundational requirement for many products developed by pharmaceutical and other healthcare startups, however a lot more preparation is required for commercial success. To create financial value, it is important that Pharma and Health Tech companies execute a well-orchestrated go-to-market strategy. Unfortunately, many companies, large and small, fail in this process due to both poor preparation and misjudging the complexities of scaling an organization quickly enough to seize the opportunities created by a successful product.

FDA approval is a foundational requirement for many products developed by pharmaceutical and other healthcare startups, however a lot more preparation is required for commercial success. To create financial value, it is important that Pharma and Health Tech companies execute a well-orchestrated go-to-market strategy. Unfortunately, many companies, large and small, fail in this process due to both poor preparation and misjudging the complexities of scaling an organization quickly enough to seize the opportunities created by a successful product.

Evolving Challenges since COVID-19

It is estimated that at least 90% of all startups fail which is representative of the healthcare market as well: 90% of startups in the healthcare market will fail or be “aqui-hired” (acquiring a company’s talent) within 2-5 years of launching. For Healthcare and Pharma startups, the product itself is rarely the problem: Failure is often the result of an unclear business model, the lack of a clear go-to-market strategy, or a poorly defined value proposition.

During the COVID-19 pandemic, many investors looked to the public health and infectious disease space as the next big opportunity, but the obstacles facing these startups were even greater than in other sectors. Not surprisingly, the main challenges which startups usually face include finding customers and securing the investments needed for their innovations. During the pandemic when compared with pre-pandemic data, these challenges increased by 20% and 8% respectively.

Post the COVID-19 pandemic, new capital has become increasingly harder to access and even more expensive due to increased risk in a volatile rate environment. While funding is still available, it has become more competitive than ever to gain investors' trust and investments. Venture Capital funds have begun looking more closely at underlying business models, growth strategies, and how successful products will be when launched at scale.

Business Planning and Quality Control

While influence in the industry and comprehensive business planning can increase the odds of commercial success, there are many circumstances out of our start-up clients’ control, including: the timing of an FDA approval, potential changes in regulation which might not get past the comment period or may require multiple iterations, delays in the next funding rounds, etc.

Despite these points of uncertainty, a company can control the quality and efficacy of its business processes and controls, in addition to how it poises itself for success within its specialty. Investors are just as much interested in the efficacy of the product as the foundation and direction of the organization overall. Especially the finance and treasury function can use the time before the FDA approval to get business processes in order and look for opportunities to build out scalable processes.

Examples of foundations which should be set early on include Finance and Treasury functions; taking advantage of the timeframe prior to FDA approval will allow a smooth implementation of business processes, thereby allowing for more opportunities to build out scalable processes.

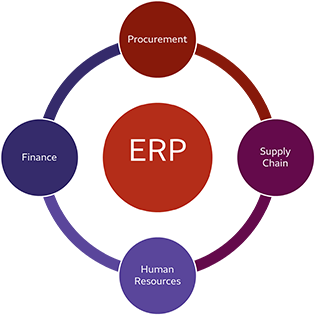

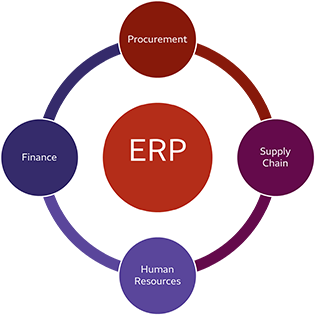

Cash flow is another particular financial measure to keep an eye on during periods of growth, especially in circumstances where additional venture funding is slower than in previous years, so paying careful attention to timing of cash flow will pay off now and in the future. By being attentive at the key moments to Treasury and Finance metrics, the growth trajectory of a startup can increase sustainably, keeping the interest of investors. Key infrastructure components which will need to be reviewed and put in place are the ERP system, HR platform, and digital payments ecosystem.

Let’s look at each one in more detail and highlight how these relate to the high growth enablement.

HR, ERP, and Electronic Payments

The implementation of an HR system to automate the HR related processes and functions of a startup are significant, and can occur either on a standalone basis, or an integrated one within the ERP. When set-up correctly, many HR related functions can be automated such as recruiting and training new employees, hiring, benefits administration, performance management, payroll, and tracking of compliance requirements. Especially in times of accelerated hiring and onboarding of new employees, the HR system needs to be scalable and compliant with the applicable state and federal regulations.

The implementation of an HR system to automate the HR related processes and functions of a startup are significant, and can occur either on a standalone basis, or an integrated one within the ERP. When set-up correctly, many HR related functions can be automated such as recruiting and training new employees, hiring, benefits administration, performance management, payroll, and tracking of compliance requirements. Especially in times of accelerated hiring and onboarding of new employees, the HR system needs to be scalable and compliant with the applicable state and federal regulations.

ERP and HR applications are held to high cyber security standards are paramount in protecting proprietary and patient data for your startup. Many hosted and cloud-based solutions of HR and ERP systems support pay-as-you go models which reduce the need for an upfront investment and leave the operations of the systems and certain cyber security matters to third party providers.

The third component involves setting up electronic payments and receivables processes that integrate with the aforementioned ERP and HR system. To ensure scalability, manual and paper-based processes should be avoided for these responsibilities. Electronic bank statements and commercial card files should be inputted into the ERP automatically to support auto reconciliation and identify exceptions, both of which would identify fraud quickly. If travel is a major requirement, a commercial travel card program will need to be established early on and will also need to support controls that align with policies and avoid sales practice issues.

Pricing and Billing Models

It is also important to think about different pricing and billing models early on which will need to be supported as part of the go-to-market strategy. Flexibility of the billing platform and integration into the Account Receivables process will be important in reducing lost revenue and in avoiding granting unwarranted discounts. Once a new product is on the market questions arise such as:

- How will orders be created?

- What payment terms will be offered to different distributors of the product and how will adherence be tracked

- Is a sales force or regional representation required to promote the new product across the US or even internationally?

- Will discounts be provided for certain markets?

Once actual sales start taking place, a key metric which should be tracked is days receivables outstanding or DSO which measures the time it takes to collect receivables once invoices are issued. The first step in taking control of DSO starts by automating the invoicing and collection process and consider solutions that match incoming payments to remittance data automatically. To optimize DSO further, receivables financing solutions can also be reviewed, thus releasing cash as well as managing the risk on the companies’ balance sheet. On the payable side, the goal is to optimize the days payables outstanding (DPO). When the pay is too slow, discount may be missed, and when pay is too quick, there may be impact to the available cash. One option to extend payment timelines without jeopardizing supplier relationships can be the use of virtual cards to give suppliers immediate payment while the company retains its working capital up to 30 days.

Data Protection and Privacy

In addition to technology and reliable data, a scalable business will require policies and controls that need to be established and documented early in the lifecycle of the company. Controls need to be enforced and their effectiveness will depend on the data quality and by the business workflows which the ERP and HR systems enforce consistently across the organization. In addition to good clinical practice (GCP), product safety and manufacturing policies, other policies, and controls to consider are:

- Data protection and privacy policy governs how sensitive information such as personal data and confidential business information will be protected

- Information security policy outlines how information systems, networks, and data will be protected from unauthorized access, theft, and cyberattacks and what to do in case of a breach

- Compliance policy specifies the company's compliance with relevant laws and regulations including DA, EMA, and other regulatory agencies.

- Investment Policy governs investment objectives, asset allocation, risk tolerance, diversification and any restrictions

- Data Quality Policy sets procedures for ensuring the accuracy, completeness, and reliability of data across the organization

- HR policies covers Recruitment and hiring, Compensation and Benefits, Time Off and Leaves of Absence, and Health and Safety

- Accounting and Finance policies governs financial reporting, internal controls, revenue recognition, accounts receivable, accounts payable, cash management, budgeting, and tax planning

Well documented policies and controls, combined with the right technology will not only enable the company to grow its operation to scale quickly but also to confidently establish SOX reporting that can hold up to the scrutiny of external auditors, and also prepare the organization for their public filings when the time comes.

Significance of Data in Securing Capital

According to Deloitte, “…products and solutions that address well-being and care delivery, along with open, secure data and interoperable platforms, are likely to continue receiving the lion’s share of funding”.

In addition to providing capital, investors and strategic partners should assume a consultative role, and bring their industry and regulatory experience to innovative startups. Advancing with technology and automation, enforcing policies and controls, establishing a unique value proposition, and most importantly, having a clear business model will all determine the success of a healthcare startup. When partnered with the best investors and consultants for them, innovators can continue to grow, improve quality of care, and deliver value to patients for a better future in healthcare.

Investing in the readiness many months or years before the formal authorization is received by the FDA might not be intuitive but lacking the capabilities and functions will lead to performance challenges or avoidable risk exposures that can hurt the future success of the company. Creating the above-mentioned functions on the fly seldomly work and unreliable financial data will most certainly impact obtaining further funding, a public offering or sale of the company.

To be successful, a company needs to find common ground with investors, customers, health care providers, patients, and potential acquirers early and often. Stakeholder input is needed early to avoid mistakes that can impede any chance of a success a company may have later down the road.

Health care companies are required to amass specific evidence and data to achieve key milestones such as raising capital, regulatory clearance or approval, and obtaining insurance reimbursement or payment. A common mistake is thinking about evidence generation in a linear manner and focusing just on what is needed for the next milestone. This is a common and costly error that can significantly delay time to success. Far too many startups succeed in achieving a regulatory milestone but then run out of funding before generating sufficient evidence to convince customers to buy their products so effective budget planning and allocating is key when it comes to evidence generation.

To avoid errors such as this, start conversations early with all relevant stakeholders about what data they will require. Also consider the Food and Drug Administration’s innovative Payor Communication Task Force; this task force involves public and private payers such as Medicare and Medicaid, private health plans, health technology assessment groups, and others in the pre-submission process in conjunction with a parallel review with the Centers for Medicare and Medicaid Services to potentially shorten the time between FDA approval and coverage decisions.

It’s essential to know who will be paying for your products and how the reimbursement will work. Misunderstanding the complicated and ever-changing economics of payment reimbursements is a costly, and easy one to make. Many health care startups develop a strategy that will let them sell straight to consumers, thinking that it would be a simpler model. They assume this way they are able to skip the time and expense consuming regulatory approval. Angel investors with small pockets tend to favor this strategy. The problem is that this relies on the often-flawed assumption that consumers are willing to pay out of pocket for health-related products and services.

Excluding the outliers who are early adopters of the out-of-pocket payments, most consumers naturally want their health plans to pay. As a result, consumer health startups often wind-up pivoting strategies in order to pursue a regulated device strategy, but many run out of the necessary funds before they get there. Making an informed decision on payments strategy early on will help to determine whether your startup will perform better by offering its innovations as regulated or as non-regulated products.

Know Your Customers and all indications for your innovations

We regularly see startups whose technology has multiple potential indications however they typically choose the initial indication based on the one the company founder knows the most about — a founder who is a liver cancer surgeon, for example, choosing liver cancer over breast cancer. This type of decision making isn’t always the right call, and the evidence generated in an incorrect initial indication can drain resources before you even have the chance to pivot.

To arrive at the best indication, complete a value proposition analysis on all indications and choose the one which is the most compelling in terms of market size, competitive landscape, and patient adoption. These qualifiers should help inform the decision on which indication to initially prioritize and pursue. After arriving at this stage, you may think your technology will be adopted because of the potential for improved patient outcomes or lowering overall costs, but if it adds steps or changes a procedure for the ones who are administering your product or service, you are not just disrupting an industry, but the key stakeholders and decision makers.

To have the greatest chance at success, the innovative health technology should integrate as seamlessly as possible into existing workflows, not delay, or interrupt them. Therefore, it’s essential to take ownership of knowing the details of every step and aspect of a customer’s workflow including every person who will be affected by it, because one weak link in the new process can potentially prevent your innovation from being adopted. For example, a surgeon may love your technology, but if it impacts a Nurse’s or Technician’s shift workload then an adoption hurdle will loom. Simulating conduct discovery, focus groups, and user testing with every key player in the actual impacted workflow in as many situations as possible can help clarify any pain points or inefficiencies before they become an obstacle in a live environment.

Being mindful of the learning points outlined in this white paper should give you a clear starting point of which pain points in your growth you may anticipate and can tackle ahead of time with your business advisory team. Staying proactive in your business strategy at every stage, maintaining a strong brand vision, offering scalable products and services adaptable to serve multiple customer types are paramount for any healthcare startup. What is even more beneficial in addition to what all strong startups have is ensuring that all key stakeholders in your company structure have a comprehensive understanding of all payment and reimbursement dynamic options which are usually moving targets.

Wells Fargo is here to help support all aspects of your startup through this exciting, innovative journey and will help you make your mark on the future of positive global healthcare outcomes. Your relationship manager will be pleased to provide more information on Wells Fargo’s financial strategies for the healthcare industry and other correspondent services.

Sign On

Sign On  FDA approval is a foundational requirement for many products developed by pharmaceutical and other healthcare startups, however a lot more preparation is required for commercial success. To create financial value, it is important that Pharma and Health Tech companies execute a well-orchestrated go-to-market strategy. Unfortunately, many companies, large and small, fail in this process due to both poor preparation and misjudging the complexities of scaling an organization quickly enough to seize the opportunities created by a successful product.

FDA approval is a foundational requirement for many products developed by pharmaceutical and other healthcare startups, however a lot more preparation is required for commercial success. To create financial value, it is important that Pharma and Health Tech companies execute a well-orchestrated go-to-market strategy. Unfortunately, many companies, large and small, fail in this process due to both poor preparation and misjudging the complexities of scaling an organization quickly enough to seize the opportunities created by a successful product. The implementation of an HR system to automate the HR related processes and functions of a startup are significant, and can occur either on a standalone basis, or an integrated one within the ERP. When set-up correctly, many HR related functions can be automated such as recruiting and training new employees, hiring, benefits administration, performance management, payroll, and tracking of compliance requirements. Especially in times of accelerated hiring and onboarding of new employees, the HR system needs to be scalable and compliant with the applicable state and federal regulations.

The implementation of an HR system to automate the HR related processes and functions of a startup are significant, and can occur either on a standalone basis, or an integrated one within the ERP. When set-up correctly, many HR related functions can be automated such as recruiting and training new employees, hiring, benefits administration, performance management, payroll, and tracking of compliance requirements. Especially in times of accelerated hiring and onboarding of new employees, the HR system needs to be scalable and compliant with the applicable state and federal regulations.