Individual Retirement Accounts (IRAs) were created to give people a tax-advantaged way to save for retirement. The biggest advantage is not having to pay taxes on investment earnings (gains, interest, or dividends) while your assets are in the account. The earlier you start to save in an IRA, the more time you have for those savings to potentially grow through the power of tax-advantaged compounding.

Tax advantages increase earning potential

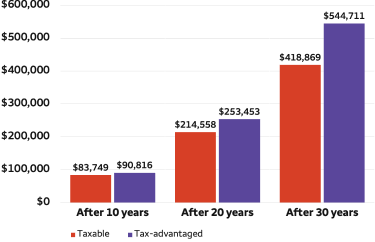

IRAs offer the potential for growth in a tax-advantaged account. Over time, that can make a significant difference in your retirement savings. Let’s look at a hypothetical example that starts with a contribution of $6,500 a year, at a 24% cumulative tax rate, and a 6% annual fixed rate of return.

Hypothetical value of $6,500 in annual contributions over 30 years

In a taxable account, the value would be $83,749 after 10 years, $214,558 after 20 years, and $418,869 after 30 years. In a tax-advantaged account, the value would increase to $90,816 after 10 years, $253,453 after 20 years, and $544,711 after 30 years.

This hypothetical example assumes an annual fixed rate of return of 6% and a 24% cumulative tax rate with $6,500 annual contributions and taxes in the taxable account paid annually. This example does not consider the advantage of deductible contributions. The growth of the tax-advantaged account is before-tax and distributions are subject to an ordinary income tax rate and may be subject to a 10% additional tax if taken prior to age 59 1/2. This hypothetical example does not represent the returns of any particular investment and should not be used to predict or project performance. There is no guarantee you will earn 6% on investments and your account value may fluctuate over time. Investing involves risk, including the possible loss of principal. It assumes all earnings are reinvested and does not include transaction costs, fees, or expenses associated with the account or any individual investments made in the account.

If the potential costs, fees, or expenses of the account and hypothetical investment had been reflected, the ending value of the tax-deferred investment could be lower.

Lower tax rates on capital gains and dividends could make the investment return for the taxable investment more favorable, thereby reducing the difference in performance between the accounts shown.

Changes in tax rates and tax treatment of investment earnings may impact the comparative results. You should consider your personal investment horizon and income tax bracket, both current and anticipated, when making an investment decision as these may further impact the results of the comparison. Wells Fargo does not provide tax or legal advice. Please see your tax and legal advisors for guidance.

Consider saving for retirement in an IRA if:

- You don't have access to a qualified employer sponsored retirement plan (QRP), such as a 401(k), 403(b), or governmental 457(b) plan.

- You are a non-working spouse, file a joint tax return, and would like to save for retirement.

- You're already saving in your QRP but would like to supplement your retirement savings.

- You're changing jobs or retiring and want to know the distribution options for your QRP.

- You have contributed the maximum amount to your QRP and would like to save an additional amount in an IRA.

Need more information? Review our IRA Frequently Asked Questions.

Choose between two types of IRAs

There are two main types of IRAs: Traditional and Roth. Both types of IRAs offer investment flexibility, tax advantages, and the same contribution limits. For more information about the differences between the two types of IRAs, including details about eligibility, visit the Traditional vs. Roth section of our IRA Center. Also, find out more about converting to a Roth IRA .

Wells Fargo has the right IRA for you

Wells Fargo can support you in your retirement planning process by providing the guidance needed to make informed choices. We begin with manageable steps that carefully balance your long- and short-term needs, working with you to design a plan to match your vision for tomorrow.

We have a variety of ways you can work with us. Get started by choosing an account.

We’re here for small business

Wells Fargo understands the unique investment and retirement challenges of business owners and the self-employed. Whether you need IRA information, a retirement plan for you and your employees, or a business valuation, you can count on us to address your financial needs. We have retirement planning ideas designed specifically for you and your business.

Sign On

Sign On